TradeSafe Service User Manual

In the stock market there are shares that trade positive, negative or no movement at all. TradeSafe service scans, processes, analyzes live trading data of shares to generate various trading reports users to list positive shares. Traders can use AI based generated reports to maximize their profits. These reports are designed in such a way that they can suit beginners as well as advanced trades. The service has designed a Intraday Report for beginners and 30+ data points presented across 20+ reports for seasoned traders. Both types of users can take advantage of the TradeSafe service to decide the best shares for the trading day.

Check out the Blog for more details.

- Intraday Report

- Quick Trade Report

- Live Trade Report

- Chart Report

- Last Hour > Breakout Report

- Last Hour > Breakdown Report

- Positional Report

- Short Sell Report

- Volatility > RSI, Trade, Chart Reports

- History Report

- Custom Search Report

The Loftus Connect feature allows users to link their trading accounts and execute intraday trades. Once your Demat account is configured with Loftus, orders are automatically placed and managed throughout the day. Order execution is based on trade status updates using the TradeSafe algorithm.

To get started, users should contact their broker to obtain the API Key and Client Secret for their account.

For IIFL, visit: https://api.iiflsecurities.com/

For Zerodha, visit: https://developers.kite.trade/signup (set Redirect URL: https://www.loftustrademechanics.com/zerodha)

If you're interested in learning how Loftus TradeSafe equity algo trading works, you can choose the broker option as 'Paper' to start paper trading.

You can track your trades by navigating to the User Menu (your name) > My Trades.

If your broker does not support API integration, you may consider opening a Demat account with one of the brokers supported by Loftus.

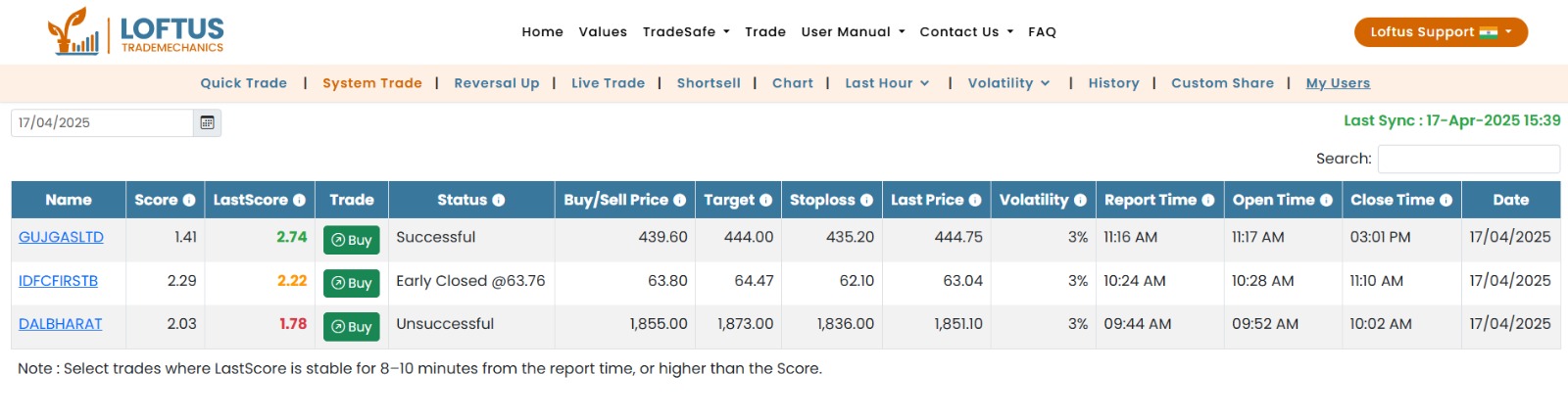

Intraday report shows you shares with Buy/Sell signals along with scores of all system identified shares. Score value greater than 1 is buy and less than -1 is sell trade. Once trades are identified, the Intraday report would show data. The report has safe buy, target, and stop loss prices which are computed based on the model by the system using a self learning algorithm. The volatility indicates the percentage of price movement it may happen based on the history data.

When the trade is identified the status is Reported, when a share starts trading on the safe buy price the status updates as Open. Now the share can hit the target or stop loss, the system shows these status updates every 5 minutes.

Moreover, the system takes care of the deep trading data points after a trade opens. It keeps checking whether the data has been reversed, in this case the system may close the trade with partially profit status with price or should tell you to close the position early as the position may go in loss, and not to wait for the stop loss price.

This report also shows time when a trade reports, opens and closes by reported time, opened time and closed time respectively. Sometimes, a trade gets identified by the system but later, the data becomes negative so the system will close such trades to protect users to not make any trade in them.

Quick Trade report enables users to get their trade information without digging much into the data. This report shows - - Share, Score, LastScore, Trade, Buy price, Target Price, Stop Loss and Last Price. Users can follow the LastScore field's color. If it appears green, the trade is strong; Orange is an alarm to review the trade as the score is getting lower. Unsuccessful trades are shown in the Red color. Black colored Last Score indicates that the trade is open. This report is best suited to beginners.

- Reported: A buy or sell trade identified by the system.

- Open: The trade has touches to the safe buy or sell price.

- Successful: Trade hits to the target price.

- Partially Successful: Trade is profitable but records lower LastScore so it indicates to book profits and not to wait for the ultimate target price.

- Early Closed: Trade has been reversed totally, users should not wait to trigger the stop loss price, indicating to close it right away.

- Unsuccessful: Trade has crossed to the stop loss price.

- Closed: Trade is closed at the end of the day if no other status is achieved.

This is an advanced technique to identify a trade. Sewing trades like volatility. The RSI reports provide a range of volatility from 2% to 6% to show up buy and strong buy signals. The volatilities reports show RSI values which are calculated to show relative strength of a share. This group of reports have chart and trade reports to show candles and general trading data points for all volatility range from 2% to 6% respectively.

System highlights quality shares in green color, however it is an indication that the system provides, you may want to apply your analysis before making a position each day. Generally speaking if Score is getting better from the last refreshed score, it is a strong trade.